Understanding Crypto Correlation Analysis

In the ever-evolving landscape of cryptocurrency, one question haunts investors: how do various cryptocurrencies relate to one another? With billions of dollars exchanged daily and a market rife with unpredictability, the concept of crypto correlation analysis becomes increasingly pertinent. According to a report from CEX.io, the crypto market saw a staggering 70% growth in user interactions in 2022, making it essential to comprehend the underlying metrics driving these digital assets.

What is Crypto Correlation Analysis?

In simple terms, crypto correlation analysis involves examining the relationships between different cryptocurrencies. By studying how the price movements of various digital assets impact one another, investors can make more informed decisions. This is similar to how stock market analysts study the dynamics between various sectors or stocks. For instance, a strong correlation might indicate that two cryptocurrencies often move in the same direction, while a weak or negative correlation suggests that one may behave differently from the other.

Why Use Crypto Correlation Analysis?

- Diversification: Investors can reduce risk by diversifying their portfolios, selecting cryptocurrencies that show low correlation with one another.

- Market Predictions: By monitoring correlation patterns, traders can anticipate market shifts and price movements.

- Risk Management: Understanding correlations aids in crafting strategies that mitigate potential losses during market volatility.

Methodologies in Crypto Correlation Analysis

There are several methodologies applied in crypto correlation analysis:

- Pearson Correlation Coefficient: Measures the linear correlation between two variables, helping identify their relationship strength.

- Spearman’s Rank Correlation: A non-parametric measure that assesses how well the relationship between two variables can be described by a monotonic function.

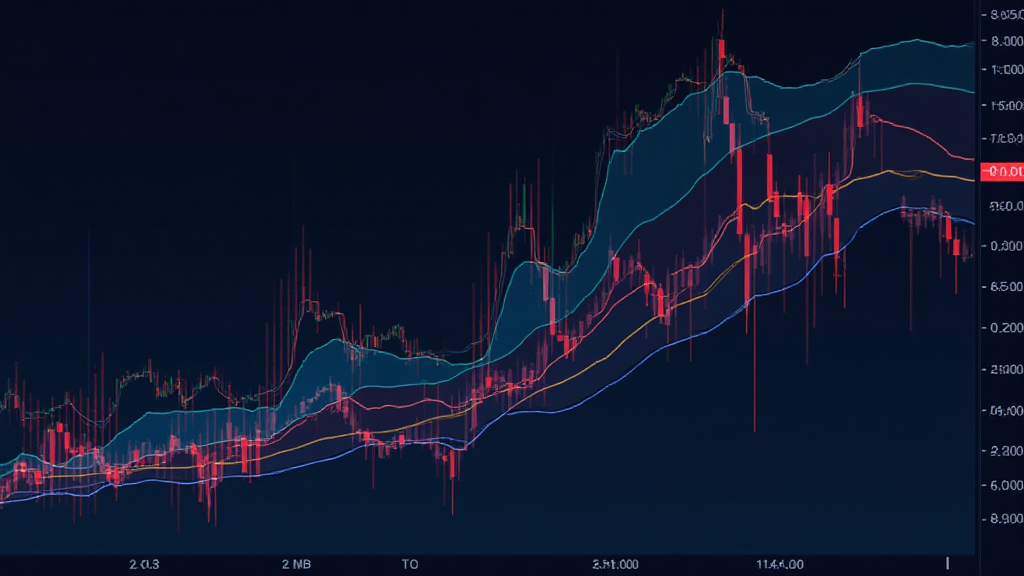

- Rolling Window Analysis: Involves calculating correlation over a specific timeframe, allowing investors to understand trends and shifts in the relationships.

The Current Landscape of Correlation in Cryptocurrencies

As of 2023, Bitcoin remains the leading digital asset, often driving other cryptocurrencies due to its substantial market dominance. Most altcoins tend to exhibit high correlations with BTC, particularly during market rallies or declines. For instance, during the drastic dip in the crypto market in early 2023, a 70% correlation with Bitcoin was documented across many altcoins, indicating a unified market response.

| Cryptocurrency | Correlation with BTC | Correlation with ETH |

|---|---|---|

| Ethereum (ETH) | 0.84 | — |

| Ripple (XRP) | 0.76 | 0.68 |

| Cardano (ADA) | 0.62 | 0.55 |

Exploring Long-Term Trends in Correlation

While short-term correlations can signal immediate market sentiment, long-term trends provide a broader view. Analysis reveals that over extensive periods, certain cryptocurrencies may decouple. For example, in 2025, it’s anticipated that emerging altcoins might create diversification opportunities due to their unique use cases and market narratives. Investors might benefit from examining potential altcoins for 2025, which may not closely follow Bitcoin’s price trajectory.

Potential Altcoins to Watch in 2025

As the cryptocurrency scene matures, here are a few altcoins that might capture attention:

- Chainlink (LINK): Known for its unique decentralized oracle network.

- Polkadot (DOT): Promises interoperability between blockchains.

- Solana (SOL): Renowned for its high transaction speeds and lower fees.

Challenges in Crypto Correlation Analysis

While understanding correlations among cryptocurrencies can benefit investors, some inherent challenges exist:

- Market Sentiment: External factors, such as regulatory news or technological advancements, can skew correlation data unexpectedly.

- Data Quality: Inconsistent data sources can lead to misleading conclusions about correlation.

- Volatility: The highly volatile nature of cryptocurrencies may mask genuine correlations.

Conclusion: The Future of Crypto Correlation Analysis

As the crypto space continues to expand, crypto correlation analysis will play a pivotal role in guiding investor strategies. The ever-improving analytical tools and methodologies outlined here put knowledge into investors’ hands, enabling wiser choices in a complex market landscape.

Ultimately, while correlation does not imply causation, recognizing these relationships helps investors navigate the uncertain waters of cryptocurrency trading. As the market pivoted towards different opportunities in emerging altcoins, updates on 2025’s most potential altcoins will help craft effective investment strategies.

As always, consider consulting financial advisors and local regulators before making investment decisions.

For more information about crypto markets, explore more at hibt.com.

Author: Dr. Minh Nguyen, an expert in blockchain technologies with over 12 published papers and leader in notable cryptocurrency audits.