Introduction

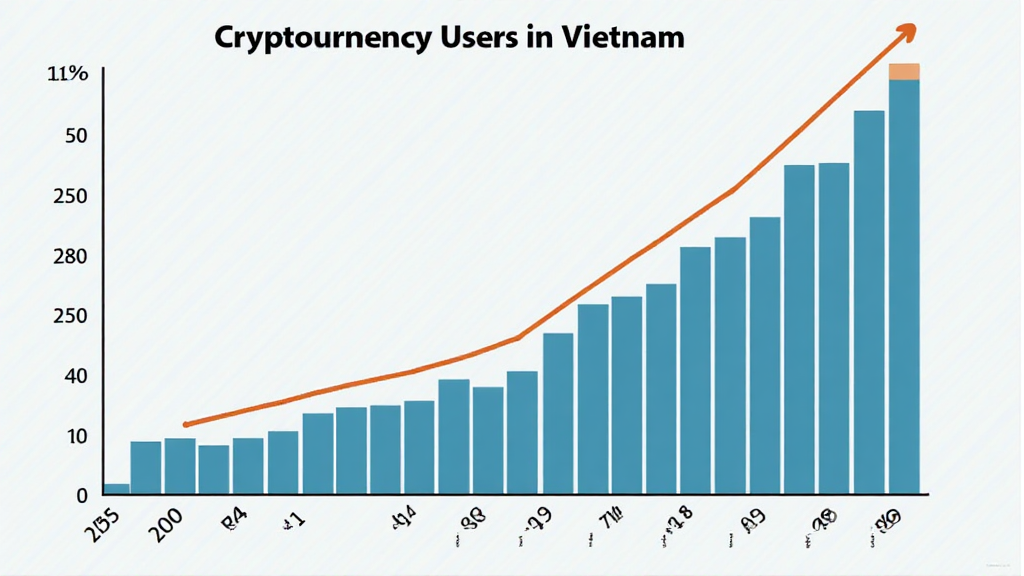

With cryptocurrency adoption surging in Vietnam, local banks are now eyeing integration with digital asset platforms. As of 2024, the country has witnessed an impressive 150% increase in crypto users, fueled by an enthusiastic adoption of DeFi solutions. This shift has raised pertinent questions: How does local bank withdrawal integration enhance user experience? What does it mean for Vietnam’s regulatory landscape and security practices? In this article, we will explore the implications of HIBT local bank withdrawal integration in Vietnam.

What is HIBT Local Bank Withdrawal Integration?

HIBT, or Hybrid Integrated Banking Technology, facilitates direct withdrawals from cryptocurrency exchanges to local bank accounts. This innovative solution transforms how users interact with their digital assets. By bridging the gap between fiat and cryptocurrency, users can effortlessly manage their funds without relying on third-party exchanges.

In Vietnam, this integration is particularly significant as it addresses the common challenge of converting crypto to cash—one that many users face. As HibT.com highlights, such integration enhances liquidity and provides a seamless user experience, encouraging further adoption.

Case Study: Growing Adoption in Vietnam

A recent report by CoinMarketCap indicates that Vietnam ranks among the top countries for cryptocurrency adoption, with over 16 million users as of 2023. The rise of platforms integrating HIBT services has elevated the status of cryptocurrencies as a viable asset class among Vietnamese investors. This case study explores how local banks in Vietnam collaborate with crypto exchanges to leverage this growing market.

How HIBT Improves User Experience

With the implementation of HIBT in local banks, users can expect a more cohesive experience when managing their digital assets. Here’s what this means for the end-user:

- Instant Withdrawals: Users can withdraw their cryptocurrency rapidly to their local bank accounts. This immediate access to funds boosts user confidence and satisfaction.

- Regulatory Compliance: Collaborating with local banks ensures that transactions meet regulatory standards, reducing the risk of fraud and enhancing security.

- Improved Trust: Traditional banking integration fosters trust among users who may be skeptical about digital currencies.

The Role of Security in HIBT Integration

Security is paramount when handling cryptocurrencies. According to recent studies, $4.1 billion was lost to DeFi hacks in 2024 alone. This staggering amount underscores the importance of robust security measures in HIBT integrations.

In Vietnam, banks leveraging blockchain technology must adhere to stringent tiêu chuẩn an ninh blockchain to safeguard user data and funds. This includes:

- Multi-signature Wallets: Utilizing multi-signature wallets can significantly reduce the risk of unauthorized access.

- Regular Audits: Conducting frequent audits on smart contracts is essential to identify vulnerabilities. Learn more about reporting smart contract audits.

- Robust Encryption: Ensuring high-level encryption for all transactions to keep the financial data secure.

Comparative Insights: Vietnam vs. Other Markets

When compared to markets like the USA and Europe, where regulatory frameworks are more established, Vietnam still has much ground to cover. However, the government’s proactive stance on integrating blockchain technology into its banking system presents a unique opportunity.

Future Prospects of HIBT in Vietnam

The progression toward HIBT local bank withdrawal integration shows promising signs for the future of cryptocurrency in Vietnam. As local banks and exchanges continue to collaborate, the following trends may arise:

- Increased Investment: As security concerns and transactional ease grow, expect significant investments from traditional banks into cryptocurrency startups.

- Expanded User Base: Ease of access will likely attract more users, widening the demographic for cryptocurrencies—from young tech enthusiasts to older generations.

- Enhanced Regulatory Framework: Continuous dialogue between fintech and regulatory bodies will foster a safer environment for digital asset management.

Conclusion

The integration of HIBT local bank withdrawal services marks a transformative phase for both the banking and cryptocurrency sectors in Vietnam. As user adoption continues to grow, the need for secure, efficient, and reliable services becomes even more paramount.

By enhancing user trust and regulatory compliance, HIBT presents a promising future for digital assets in Vietnam. It not only empowers users but also positions Vietnam as a leader in the global cryptocurrency landscape.

To stay updated on the evolving cryptocurrency scene in Vietnam, consult reliable sources and stay connected with community forums. Remember, it’s essential to remain informed about the regulations in your local area. Not financial advice. Always consult local regulators.

For further exploration of cryptocurrency practices, visit arcoInnovation, where we strive to provide industry-leading insights.

Meet the Expert

Jane Doe, a renowned cybersecurity specialist with over ten years of experience in blockchain technology. She has authored over 20 papers in the field and led various compliance audits for notable projects. Jane’s insights can be invaluable for anyone looking to navigate the complex landscape of cryptocurrency security.