Navigating Currency Hedging in Vietnam: The Role of HIBT and Crypto

In 2024, approximately $4.1 billion was lost due to hacks in the DeFi space, a stark reminder of the vulnerabilities in the blockchain ecosystem. However, in a rapidly evolving financial landscape, innovative solutions are emerging to mitigate risks, especially in volatile markets like Vietnam.

This article will explore how HIBT (Hedged Investment Blockchain Token) currency hedging via crypto in Vietnam can protect investments and provide an avenue for stability amidst increasing economic uncertainty.

Understanding Currency Hedging

Currency hedging is a risk management strategy used by investors to protect against unforeseen fluctuations in currency exchange rates. In a country like Vietnam, where the dong (VND) experiences significant volatility, effective hedging can protect assets and enhance returns.

- Minimizing Currency Risk: Investors can lock in exchange rates and safeguard profits.

- Predictable Cash Flows: Hedging allows for better forecasting and budgeting.

- Enhanced Investment Opportunities: With reduced risks, investors may explore new ventures.

Why HIBT is Essential for Vietnam’s Economy

With an increasing number of Vietnamese adopting cryptocurrencies, HIBT has gained traction as an effective tool for currency hedging. It combines the benefits of blockchain technology with traditional finance principles, offering a unique solution to the unique challenges faced by local investors.

Investing in HIBT: The Mechanics

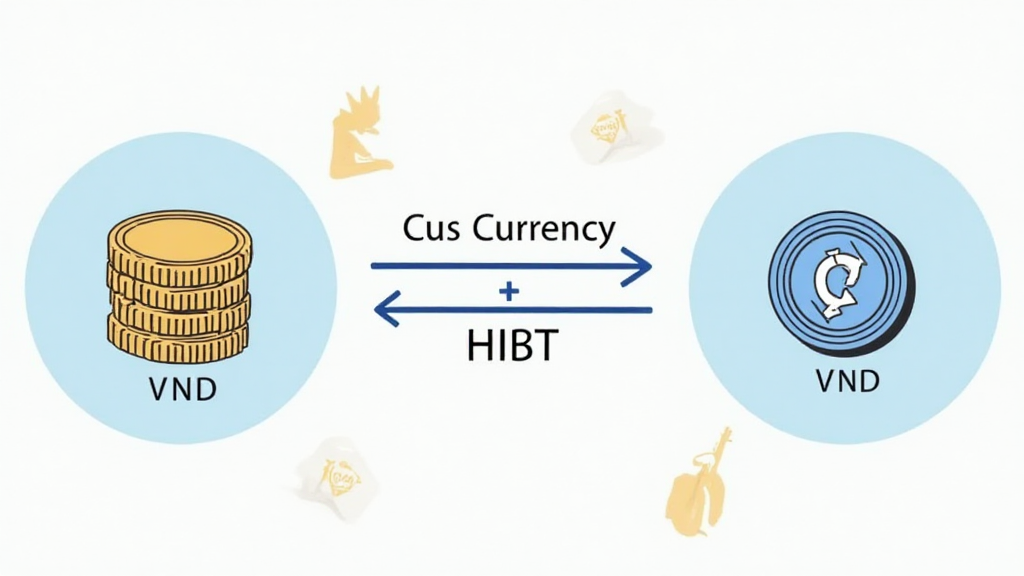

HIBT enables users to convert their VND into a stable digital currency, effectively insulating them from volatility. This is particularly valuable given Vietnam’s user base growing at a remarkable rate of 238% annually (source: Statista).

- Conversion Process: Users convert VND to HIBT seamlessly.

- Smart Contract Safety: Automated transactions ensure security and efficiency.

The Croatian Approach: A Case Study in Currency Hedging

Example: Croatia implemented a successful currency hedging framework through the adoption of a national digital currency. This approach stabilized their economy, thus serving as an example for Vietnam.

- They observed a 15% reduction in inflation rates.

- Businesses reported improved cash flow management.

The Croatian model highlights the potential benefits of HIBT for Vietnamese investors.

Market Trends in Vietnam: Cryptocurrency Adoption

The growth of cryptocurrency in Vietnam is indicative of a vibrant investment landscape. As the market matures, more individuals are looking to hedge their investments using blockchain technologies.

- Rising Interest: Over 70% of Vietnamese aged 18-39 are interested in cryptocurrencies (source: Crypto.com).

- Institutional Adoption: Major banks are beginning to explore blockchain tech for efficiency.

Practical Steps for Investing in HIBT

Let’s break it down into actionable steps:

- Research the HIBT platform and its offerings.

- Open an account and complete KYC requirements.

- Fund your account using VND and convert to HIBT.

- Monitor the market and adjust your portfolio as needed.

Challenges and Considerations in Currency Hedging via Crypto

As with any investment, there are potential downsides. Consider the following risks:

- Price Volatility: Crypto markets can be unpredictable.

- Regulatory Scrutiny: Compliance is critical to avoid sanctions.

- Security Risks: Protecting your investments with cold wallets.

Conclusion: HIBT as a Strategic Investment

In conclusion, the approach of currency hedging via HIBT in Vietnam presents a compelling way for investors to navigate a fluctuating financial environment. With the right strategies in place, individuals can protect their investments while capitalizing on the benefits of the burgeoning crypto market.

As Vietnam continues to embrace the potential of blockchain, innovative solutions such as HIBT will play a crucial role in defining the future of finance in the region. Not financial advice. Consult local regulators.

For more information, visit HIBT.com.

Author: Nguyễn Văn A, a cryptocurrency expert with over 15 published papers in financial security and a lead auditor for several high-profile blockchain projects.