Exploring Blockchain Consensus Mechanisms: Enhancing Security in Digital Transactions

With over $4.1 billion lost to DeFi hacks in 2024, understanding blockchain consensus mechanisms has never been more crucial for digital asset security. As cryptocurrencies and blockchain technologies have permeated various sectors, ensuring the integrity and security of these systems is a prime concern for stakeholders. This article will dive into the different consensus mechanisms that bolster the effectiveness of blockchain networks, examining their usage in real-world scenarios and their evolution towards 2025.

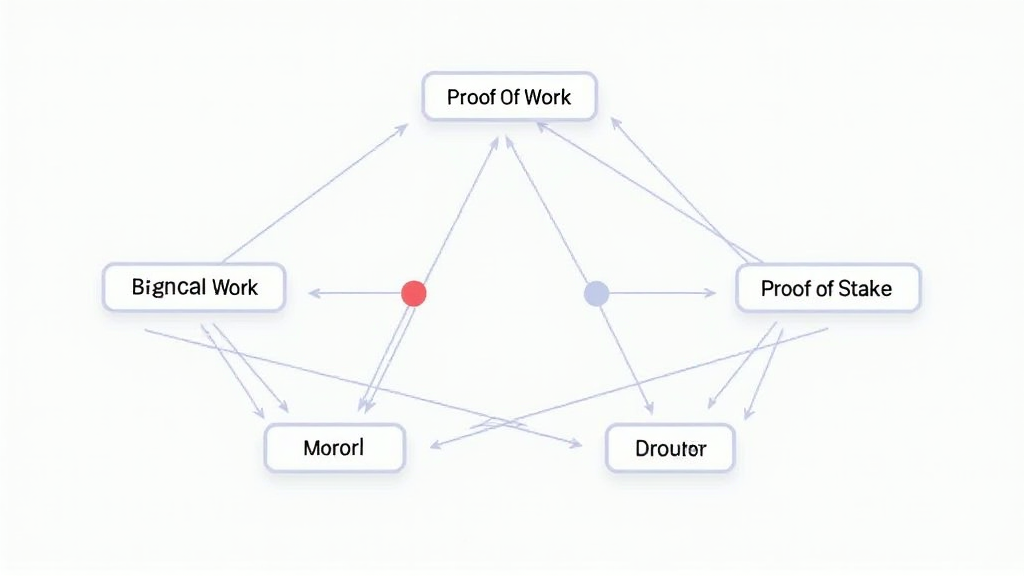

Understanding Blockchain Consensus Mechanisms

Consensus mechanisms are the protocols that consider a transaction as valid and confirm it across the blockchain network. Think of it like how banks verify transactions: there is a need for agreement, ensuring every participant in the network finds the information trustworthy. Here’s a breakdown of the most prominent mechanisms:

- Proof of Work (PoW): Originally employed by Bitcoin, PoW requires miners to solve complex mathematical problems. While ensuring high security, it demands significant computational resources.

- Proof of Stake (PoS): This more energy-efficient alternative allows validators to create blocks based on the number of coins they hold and are willing to ‘stake’ as collateral.

- Delegated Proof of Stake (DPoS): A variation that employs a smaller group of validators voted from the community, enhancing speed and efficiency.

- Proof of Authority (PoA): Primarily used in private networks, it relies on a few selected nodes to validate transactions, drawing on their reputational trust.

- Practical Byzantine Fault Tolerance (PBFT): Designed to work in environments where nodes might be untrustworthy, it allows a network to reach consensus despite some nodes failing.

How Consensus Mechanisms Enhance Blockchain Security

Security is vital in the world of digital assets; understanding how consensus mechanisms contribute to this can reveal their importance. Let’s compare different mechanisms with real-world analogies:

- If you think of PoW as a robust vault requiring strength to open, it holds the highest level of security but is costly in terms of energy usage.

- PoS, meanwhile, resembles a bank where since each client’s deposit contributes to the bank’s overall security, it strengthens the system with less energy.

According to recent data, about 65% of all new blockchain projects adopted PoS and its variants in 2025, marking a significant trend towards sustainability.

Consensus Mechanism Vulnerabilities

No system is flawless, including consensus mechanisms. In this section, we’ll analyze some vulnerabilities:

- 51% Attack: A scenario where an entity controls over half of the network’s mining power, potentially leading to double spending.

- Centralization Threat: With PoS, there’s a risk that the wealthiest participants can dominate, leading to unequal power distribution.

- Sybil Attack: Involves creating multiple fake identities to gain influence in the network, threatening the integrity of the consensus process.

Understanding these vulnerabilities is crucial for developers and investors alike. As highlighted by data from Chainalysis in 2025, approximately 18% of blockchains were tested for resistance to these attacks, indicating a growing cognizance of potential threats.

Future Trends in Blockchain Consensus Mechanisms

Looking towards 2025, there are several trends emerging in the realm of blockchain consensus mechanisms, particularly relevant to the Southeast Asian market, including Vietnam:

- Sustainability: A push towards energy-efficient mechanisms like PoS is gaining traction, as evidenced by a 40% increase in Vietnamese blockchain projects favoring this model.

- Interoperability: Future blockchains may begin to adopt hybrid models that incorporate both PoW and PoS to balance security and efficiency.

- Regulatory Compliance: The need to comply with local regulations will necessitate adjustments in consensus mechanisms, as seen already in emerging markets like Vietnam, where an estimated 30% growth in crypto regulation adherence is reported.

Real-World Applications of Consensus Mechanisms

To appreciate the impact of these mechanisms, let’s delve into real-world applications:

- Ethereum 2.0: Transitioning to PoS aims to make the network more scalable, energy-efficient, and secure.

- Cardano: Utilizing a unique proof of stake system, Cardano offers a robust solution for decentralized application (dApp) development, appealing to many Vietnamese developers.

- Hyperledger Fabric: Employing a modular approach, companies can customize consensus mechanisms based on their specific requirements, appealing in corporate settings that prioritize confidentiality.

According to data from Statista, Vietnam has one of the highest growth rates for blockchain development, projected at 45% annually, showcasing the vibrant ecosystem adapting these consensus mechanisms.

Conclusion: The Path Forward for Blockchain Consensus Mechanisms

As we navigate through 2025, the landscape of blockchain consensus mechanisms will continue to evolve, driven by the dual necessities of security and efficiency. Understanding these mechanisms will become increasingly important for participants in the blockchain ecosystem. While vulnerabilities persist, strategic advancements will help mitigate risks and enhance security.

At arcoInnovation, our commitment to fostering knowledge and security in digital transactions is paramount. We encourage continuous learning about blockchain consensus mechanisms as they redefine how we see digital asset security.

For more insightful information, be sure to explore additional resources relevant to crypto security and blockchain technology.

Written by Dr. Nguyen Tu, a renowned blockchain researcher with over 30 published papers and extensive experience leading audits for notable projects.