Introduction

With the crypto market maturing rapidly, Vietnam’s crypto user growth rate has surged significantly. In 2023 alone, reports from Statista indicate that Vietnam had over 20 million cryptocurrency users, up from 15 million in 2021. This growing interest reflects a larger global trend, particularly in the realm of NFT fractional ownership—a concept that’s transforming how individuals think about and manage digital assets.

This article will guide you through the intricacies of NFT fractional ownership, explaining its value, characteristics, and potential impact on the market.

Understanding NFT Fractional Ownership

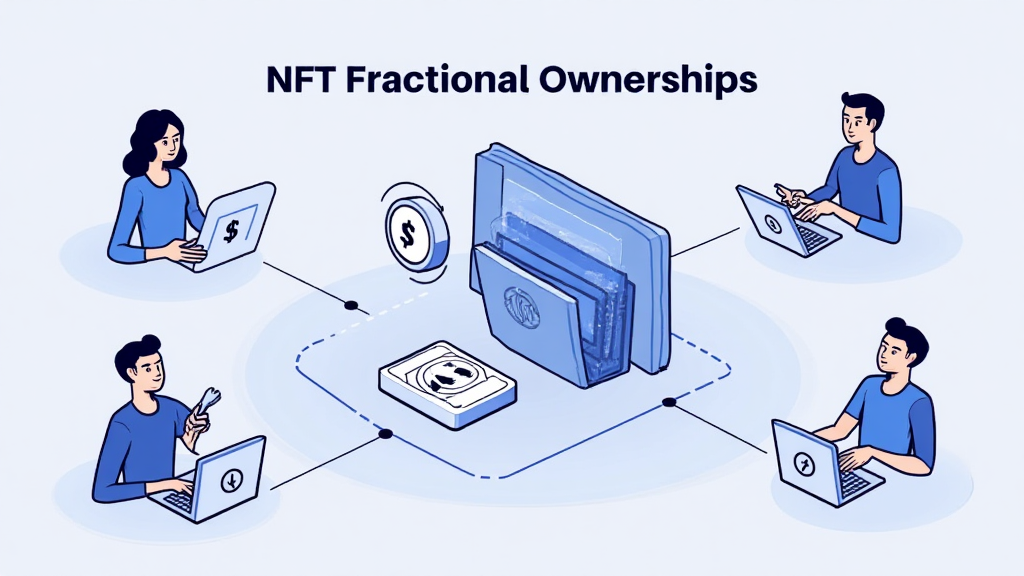

At its core, NFT fractional ownership involves dividing a Non-Fungible Token (NFT) into smaller, tradable pieces, allowing multiple individuals to invest in a single asset. This concept draws intriguing parallels to traditional art investments; rather than one person purchasing a high-value painting, a group of friends might collectively own shares of it.

- Example: A renowned artist’s NFT could sell for $1 million, with shares available for $10,000 each. Twenty investors can own fractions of this valuable digital asset.

But why is NFT fractional ownership becoming increasingly popular? Here are a few reasons:

- Accessibility: Fractional ownership lowers entry barriers for investors.

- Diversification: Investors can easily diversify their portfolios.

- Illiquid Assets: Allows liquidity for traditionally illiquid assets.

The Growth of NFT Fractional Ownership in Vietnam

The emergence of NFT markets, particularly in Asia and specifically in Vietnam, has captured global attention. In 2023, NFT trading volume in Vietnam reached $150 million according to CoinMarketCap. This surge illustrates the local market’s embrace of this innovative concept.

Factors contributing to growth include:

- Increased internet accessibility across Vietnam.

- Youth engagement in digital art and collectibles.

- Government interests in blockchain technology.

Benefits of NFT Fractional Ownership

Investing in fractional ownership of NFTs provides several advantages:

- Lower Financial Risk: Investors can mitigate risk by owning fractions of multiple NFTs rather than one.

- Portfolio Diversification: Easier access to a variety of assets helps in diversifying investments.

- Community and Collaboration: Allows for collective decision-making in asset management.

Like a bank vault for digital assets, NFT fractional ownership presents a secure way to invest in high-value items without necessitating full ownership.

Challenges and Considerations

Despite its many benefits, the NFT fractional ownership model comes with unique challenges:

- Regulatory Framework: The legal status of fractional ownership in many jurisdictions remains ambiguous, affecting its attractiveness.

- Valuation Issues: Determining the accurate value of NFTs can be complex and highly subjective.

- Market Volatility: The NFT market is still relatively young and can experience significant price fluctuations.

These challenges necessitate diligence and caution from investors. As with any investment, understanding the space and conducting thorough research is essential.

Future Trends in NFT Fractional Ownership

Looking ahead, several trends are set to shape the future of NFT fractional ownership:

- Integration with DeFi: NFTs could soon be integrated with decentralized finance protocols to enhance liquidity.

- Broader Adoption by Artists and Influencers: More creators will likely leverage fractional ownership to engage their fans.

- Emergence of Fractional Ownership Platforms: Specialized platforms facilitating NFT fractional sales are on the rise.

These trends signify that NFT fractional ownership is more than a passing fad; it is laying the groundwork for a new frontier in the digital assets landscape.

Navigating the Legal Landscape

It’s crucial that all participants in the NFT fractional ownership space remain aware of the relevant legal implications. For instance, NFT transactions may attract certain regulatory scrutiny, as noted by the recent guidance from the U.S. Securities and Exchange Commission (SEC) indicating that some forms of NFTs could be considered securities.

This applies particularly to fractional NFTs that potentially qualify as investment contracts. Investors should seek to understand local regulations to avoid running afoul of compliance laws in their respective jurisdictions.

Practical Tips for Investors

For aspiring investors in NFT fractional ownership, here are some practical recommendations:

- Research the Platform: Ensure that the platforms you choose have a solid reputation and user reviews.

- Diversify NFTs: Invest across different NFT categories to mitigate risk.

- Stay Informed: Engage with communities and follow NFT news to keep abreast of trends.

Case Study: A Successful NFT Fractional Ownership Project

One notable example of successful NFT fractional ownership is the platform Hibt.com, which recently launched a collection allowing users to own fractions of a pioneering digital artwork. This project exemplifies how NFT fractional ownership can be effectively implemented, and it opens the door for discussions on community governance over owned assets.

Conclusion

The NFT fractional ownership model signifies a transformative shift in how individuals engage with digital assets. By breaking down financial barriers, it democratizes access to high-value assets, allowing more investors to partake in the burgeoning NFT market. However, participants must navigate the challenges and understand the legal landscape to harness its full potential effectively.

As the Vietnamese market continues to evolve alongside global trends, platforms for NFT fractional ownership will likely play a pivotal role in reshaping asset ownership. With an informed approach and a keen eye on market developments, investors can confidently venture into this innovative investment space.

For more insights and detailed resources on navigating the world of NFT fractional ownership, consider checking back with the latest updates from arcoInnovation.

Author: Dr. Peter Nguyen

Experienced blockchain consultant with over 15 published papers in the field, specializing in auditing decentralized finance projects.